Setting and sticking to budget can be overwhelming, especially with so many different resources on the market. I grew up with a mom who was a budget & finance pro, so I learned at a young age how to save, manage money and set my own budget. Today I'll be sharing my top tips for how to start and maintain your own budget.

My Budget History

When I graduated college my mom sat me down and helped me make my first "adult" budget based on my teaching salary (which was dismal). With time I learned to manage my budget using a combination of excel and budget software and have since shared these invaluable skills with my husband and friends helping them feel successful with their finances.

This blog post will touch on my core tips for starting and maintaining a budget, so let's jump right in.

Step 1: Determine Your Income & Expenses

The first step before you jump into setting budget goals is to look at your income and expenses. You have to know what you bring in and what money consistently goes out before you can make a plan. In my first job as a teacher I had a very small income so I had to be creative with how to make ends meet and still have a little fun.

DOWNLOAD BUDGET TEMPLATE and watch the instruction video to get started inputing your known expenses and income.

Step 2: Evaluate your current spending

After you have a list of your income and set expenses, look at your other areas of spending that may fluctuate (eating out, shopping, amusement, hobbies etc).

The key to this step is reviewing without judgment.

It's important when reviewing your spending to account for everything, even that $10 you spent on drinks and snacks at the gas station or that bar tab once a month. Your budget projects need to be accurate in order for you to be successful. Once you know where your money is going you can set goals and change habits. Knowledge is the first step.

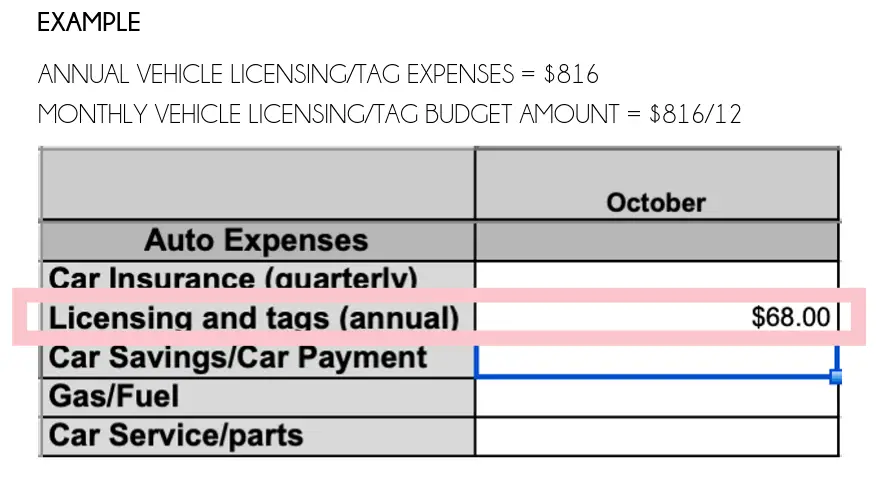

Once you know all your current spending categories, determine which expenses are monthly and which are annual. I like to track everything on a monthly basis so quarterly or annual expenses get divided into a monthly amount.When annual bills come due, I already have the money available and accounted for.

By this point in the process, you should have many rows in your spreadsheet. It's Ok for some of these numbers to be estimates. As I will touch on later, you will continue to adapt these budget numbers based on your trends and goals in the coming months.

Step 3: Plan for Savings | Account for fun

The biggest and most important lesson my mom taught me about budgeting is to account for savings AND fun no matter how small the amount.

What do you want to save for? Maybe it's a vacation, a new outfit or a special dinner. Make a category for this item/event and something towards that goal every month.

I like to have multiple savings categories. We save for emergencies, baby expenses, big purchases (like my handbag), vacations and more. I like to keep each savings category separate so I can clearly track how much money is available in each category at the each month, quarter or year.

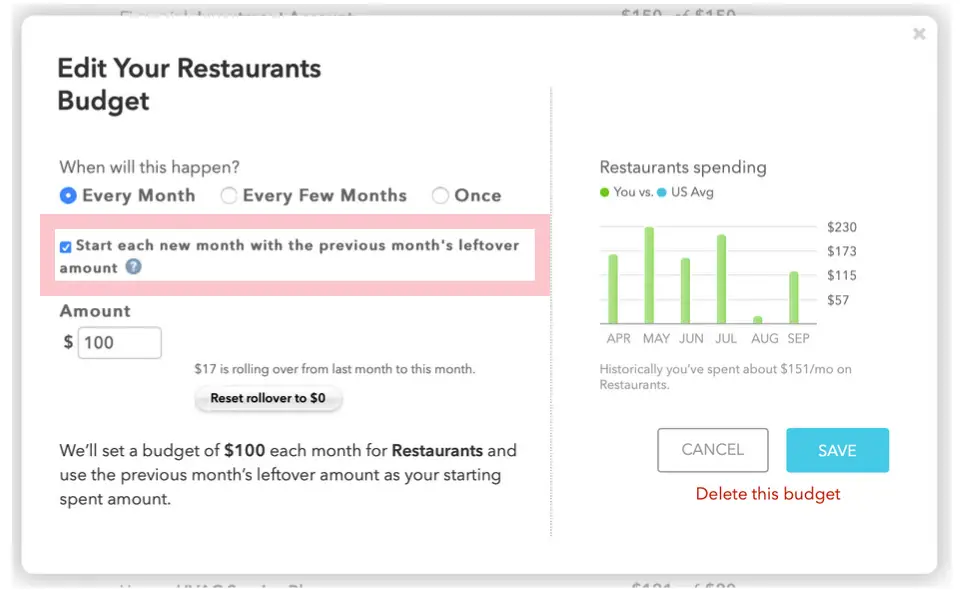

Here is what that savings/carry over balance looks like in our online budget software. Note that in this case "budgeted" = "saving".

Step 4: Select a Budget Software

I have been using Mint as our budget software for 10 years and it is my best friend. I have explored other softwares and nothing compares. Maybe Mint wants to sponsor this post haha.

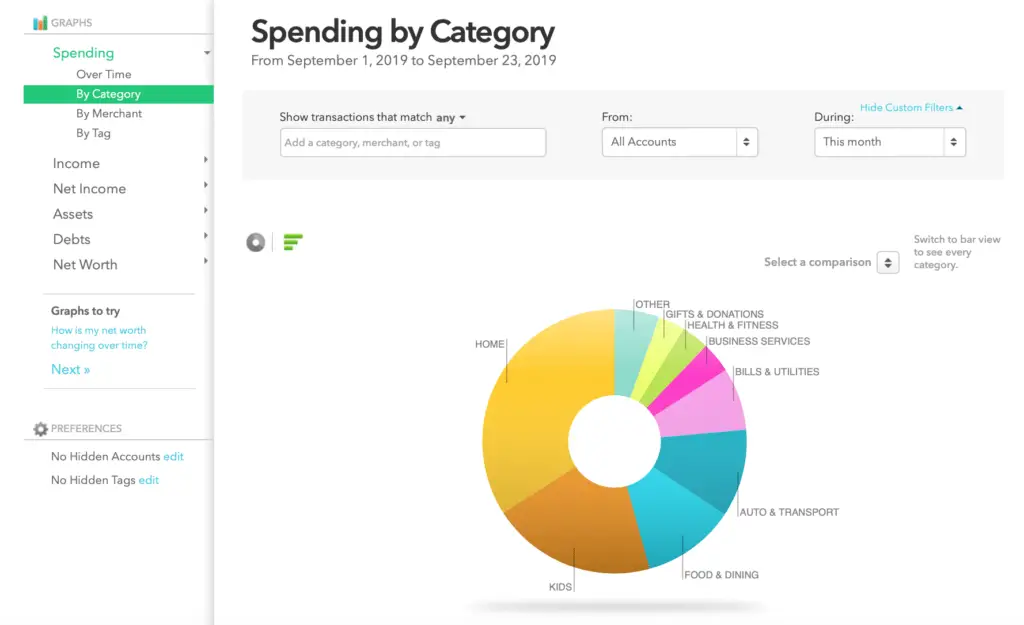

Mint syncs all of our data from credit cards, loans, bank accounts, investments and gives me a holistic view of our finances.

Not only is Mint free, but it's extremely user friendly. I am able to customize the budget categories to meet our needs, track spending habits, and make adjustments from month to month.

I love the visual aspect of Mint. At a glance I can quickly see which categories have money available, which areas are almost depleted and where we have overspent.

Step 5: Setting Up Your Budget in Mint (or alternate software)

You will set up your budget in Mint using the budget template spreadsheet you download and filled out thus far.

For each budget category you create in Mint be sure to check the option to carry over money from month to month. This is essential for tracking savings, and planning for annual expenses.

The color bars indicate the progress towards or over the budgeted amount each month. Grey shows a positive balance carried over. Green shows that the spending is under the budgeted amount and red shows an overage.

These screenshots are all from the Mint desktop display but it is worth noting that the app is also great for quick on-the-go management.

Step 6: Set Budget Accountability Checkpoints

Changing your mindset is just as important as the technical aspects of budgeting. Budgeting is not a "set it and forget it" process. It requires long term commitment and investment in the management process.

At the beginning, your accountability checkpoints will need to be more frequent. You'll want to be checking your budget/spending weekly if not daily to help keep yourself on track.

Overtime Mint learns your habits, and can categorizes your purchases with more accuracy which requires less manual management on your end. You will still need to be checking to monitor your spending habits and adjust throughout the month.

PRO TIP: Once you start budgeting, it is essential you do NOT use your checking account to determine your available funds. This is the biggest mindset shift. Instead, use your budget categories and balances to guide your spending and reflect your savings.

If you have trouble staying on track alone, think about finding an accountability partner. This could be a spouse, a friend or a family member. Don't worry about sharing your actual finances with this person, instead think about ways you can check in on each other's spending habits and budget skill development.

My friend Chelsea and I text each other to help control our spending when it comes to clothes! It's a great reality check and sometimes just texting a friend before purchasing gives you time to make a more thoughtful decision.

Don't want to have an accountability buddy? Build in routines that force you to stop and think before finalizing purchases. This could be as simple as get up and walk away from the computer or walk around the store before checking out. The key is intentionality.

Step 7: Manager Overages

So what about the reality where you overspend in one area? Don't worry, it happens. We still do this all the time after 10 years of focused budgeting. The key is being aware in real-time of your spending and making adjustments to account for the overages.

The more you are checking your account, the easier it is to make real-time adjustments. For example, if I had been checking more closely this month, I would have seen we were nearing our budget max in restaurants and should have adjusted my schedule to cut back.

If I am not checking regularly (like this month) and find overages when reconciling at the end of the month, I will manually move money from another category with excess to ensure we are flush and accurate in terms of our overall available funds.

Step 8: Reflect & Adapt

At the beginning you need to show yourself some grace. You're learning your spending habits and will be adapting based on your goals.

Even after many years, we make adjustments to our budget based on life changes (baby/cancer), new savings goals or unknown expenses like appliance damage, car issue, etc.

The goal is to constantly reflect on your habits and plan ahead. When you are honest with yourself about your available funds and spending, you can better adapt to the unknown. Emergencies happen and life is unexpected but budget knowledge, savings and practice will help you navigate those crisis with more ease.

Step 9: Celebrate milestones

While this tip is at the end, it's one of the most important! Budgeting is not about restriction or punishment. It's about responsible spending and freedom. When you are conscious of your spending and planning for the future, you will end up with more money saved and movement towards your goals.

I will never forget the first year my husband (then fiancé) and I combined our finances. We had very different approaches to handling money.

"The way I used to budget was to remember how much money I needed for my fixed monthly costs, pay those bills and then check my online balance to see how much money I had left. I would then spend until my bank account was down to zero" - Mac

After a year of combined finances and focused budgeting, we had saved over $10,000 for our first home purchase. Mac was blown away.

Budget + Blogging

This doesn't really fall into any of my budget steps, but so many of you asked about it, I wanted to touch on the topic of blogging and budgeting.

When I first started blogging, I was not making any money. In fact I was spending a lot of money for website & hosting fees, graphic design tools, products, trips, etc. To account for these investments in my business we pulled from savings and our monthly income.

As time passed my blog expenses because more predictable so we were able to more accurately budget, but my blog income still wasn't enough to cover all the expenses.

Last Spring I was finally able to move all my blog income and expenses to a business account. Keep in mind it took me almost 4 years of blogging to get to a point where my blogging income could cover the expenses and maintain a steady balance from month to month. I make money from writing jobs, affiliate links, ads, and long term consulting/partnership relationships.

If you are in the early stages of blogging or a small business I highly suggest you put aside savings to cover your expenses. Think about every purchase you make as an investment in business.

In terms of determining that amount you can invest, that will be different for everyone. The important part is to be realistic about your means. Blogging is not about spending money you don't have, it's about authenticity and hard work. Every purchase for your new business should bring some value or return.

The End

Wow this may be the longest blog post I have written in ages! I hope all this information was helpful. If you all want more blog posts about budgeting/finances let me know. I love helping people take ownership of their finances through budgeting and saving.

Breast cancer survivor, lover of style, beauty and all things pink! Inspiring you to thrive through adversity.

READ MORE

- « Previous

- 1

- 2

- 3

- Next »

7 Comments